Top Finance News this Week. All Without Annoying Paywalls

You know were all about getting rid of paywalls. He are some of the top news stories this week and their summary that we read without any paywalls. They all have their own links so you can enjoy them too without needing to pay a dime. We covered our favorites in tech and finance for this week. Enjoy!

1) US House moves closer to vote over aid for Ukraine and Israel

Summary

The US House of Representatives is poised to vote on providing additional aid to Ukraine and Israel, with a proposed $95bn package aimed at bolstering their defenses. The move, spearheaded by Republican Speaker Mike Johnson, comes after months of congressional inaction and mounting pressure from allies worried about Russia's aggression and Iran's recent attack on Israel.

The legislation includes funding for Ukraine to strengthen its military against Russian forces, as well as support for Israel and Taiwan. President Joe Biden has expressed strong support for the package, emphasizing solidarity with allies and opposition to adversaries like Russia and Iran.

However, Johnson faces challenges within his own party, with some right-wing members threatening to remove him as Speaker if he allows the aid vote. He may need Democratic support to pass the legislation and retain his position.

The timing of the aid is crucial, as Ukraine struggles against increasing Russian attacks, and Israel faces threats in the Middle East. The approval of the bill could provide essential resources for Ukraine to defend itself and potentially halt Russia's advance.

Despite the urgency, passage of the bills is uncertain due to the narrow Republican majority in the House. Johnson's leadership is also under scrutiny, with some party members questioning his decisions.

Overall, the proposed aid package reflects a bipartisan effort to support key allies and counter regional threats, but its fate remains uncertain amid political tensions and internal party divisions.

2) High-speed trader Jane Street raked in $4.4bn at start of 2024

Summary

Jane Street, a secretive high-speed trading firm, has seen its quarterly trading revenues soar to their highest levels since the onset of the pandemic. Expected to reach approximately $4.4 billion for the first quarter, this marks a significant increase from the previous year and a 35% jump from the end of 2023, as per documents reviewed by the Financial Times.

These remarkable figures underscore Jane Street's emergence as a dominant force in global financial markets, surpassing many big rivals and banks in earnings. With an estimated net income of around $2.7 billion for the quarter, the firm boasts a net profit margin exceeding 60%, leading to profits totaling roughly $7.4 billion over the past 12 months.

Jane Street's trading prowess extends across tens of thousands of products, including currencies, exchange-traded funds (ETFs), and options. Notably, the firm's role in cryptocurrency markets has also grown significantly, with over $200 billion worth of coins traded in the past three years, particularly benefiting from the surge in Bitcoin trading following the launch of cryptocurrency-tracking ETFs in the US.

The company's strong financial performance has prompted plans to raise $1.25 billion in bond markets to further expand its operations. Founded in 2000, Jane Street has diversified its financing sources in recent years, securing loans from institutional investors and establishing credit facilities with major banks like JPMorgan.

While Jane Street's net trading activity experienced a modest decline in 2023 due to decreased volatility compared to the previous year, the firm remains a formidable player in the trading landscape, leveraging its capital to maintain margin requirements with prime brokers across Wall Street and fuel its trading operations.

3) House Moves Toward Bundling TikTok Bill With Aid to Ukraine and Israel

Summary

The House of Representatives is ramping up efforts to address national security concerns surrounding TikTok, the popular social media app owned by the Chinese company ByteDance. Their latest move involves pushing legislation that would either compel ByteDance to sell TikTok or outright ban its operation in the United States.

This legislative push involves Speaker Mike Johnson, who intends to combine the TikTok-related measures with foreign aid provisions for Ukraine, Israel, and Taiwan. The proposed legislation grants ByteDance a longer timeframe of nine months to divest TikTok, with a potential 90-day extension if progress is made toward a sale. The House is set to vote on this package, including the TikTok ban and other popular bills, in a strategic move to garner support for the foreign aid measures. Should the package pass the House, it would then move to the Senate for consideration.

The concern driving this legislative effort is the perceived national security threat posed by TikTok's Chinese ownership. Lawmakers worry about the potential for Beijing to access or manipulate user data for propaganda purposes. While TikTok has vehemently denied these allegations and proposed measures to address security concerns, the push for divestment persists.

TikTok's influence on American culture and politics is substantial, with millions of users and billions of dollars contributed to the U.S. economy. However, critics argue that these benefits are outweighed by the potential risks to national security.

The fate of this legislation in the Senate remains uncertain, with potential legal challenges looming if it becomes law. Despite these challenges, the effort to address TikTok's ownership structure has garnered bipartisan support, with backing from the White House and intelligence agencies.

Ultimately, the outcome of this legislative push will shape the future of TikTok's operations in the United States and could have broader implications for the regulation of social media platforms with foreign ownership.

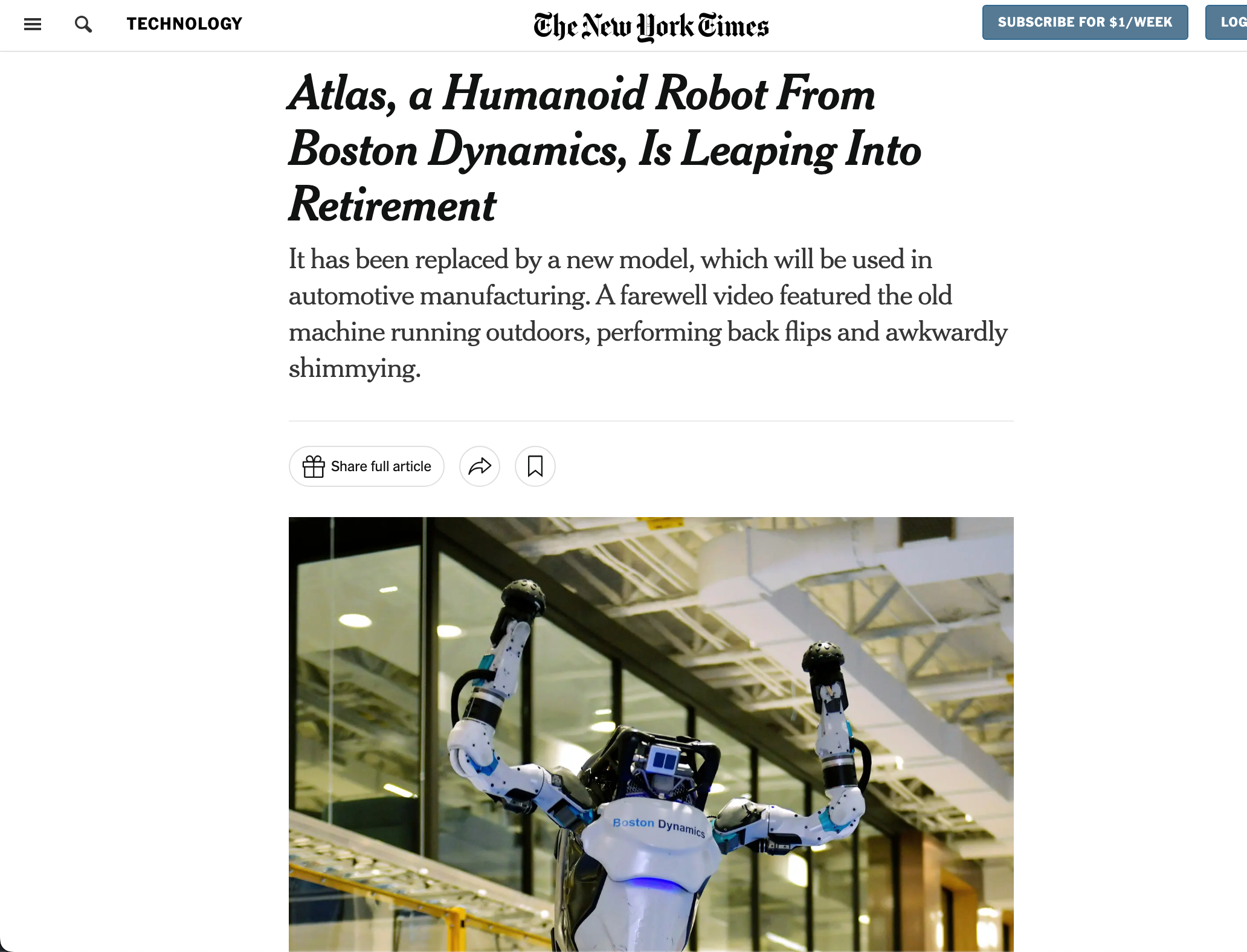

4) Atlas, a Humanoid Robot From Boston Dynamics, Is Leaping Into Retirement

Summary

Boston Dynamics, the company known for creating the humanoid robot Atlas, has announced the retirement of the iconic robot after more than a decade of captivating audiences with its feats of agility and balance. The original hydraulic Atlas, designed for research purposes and famous for its outdoor running, dancing, and backflips, will be moved to the company's "robot retirement home" for display alongside other decommissioned robots.

The retirement marks the transition to a new generation of humanoid robots designed for real-world commercial and industrial applications. The latest iteration of Atlas is fully electric and equipped for various tasks, representing a significant advancement in robotics technology.

Over the years, the original Atlas has been instrumental in advancing research on full-body mobility and exploring the possibilities of robotics. Despite its occasional mishaps, such as stumbles and hydraulic fluid leaks, Atlas has inspired roboticists and pushed the boundaries of the field.

The new Atlas boasts improved features, including a more nimble design and capabilities suited for industrial use. Boston Dynamics plans to collaborate with Hyundai Motor Company to deploy the new robot in automotive manufacturing.

The original Atlas, funded by the Defense Advanced Research Projects Agency (DARPA), made its public debut in 2013 and underwent several updates during the DARPA Robotics Challenge. While the retirement marks the end of an era for the hydraulic Atlas, it signifies the beginning of a new chapter in robotics with advanced models like Spot and Stretch continuing to push the boundaries of mobile robotics.

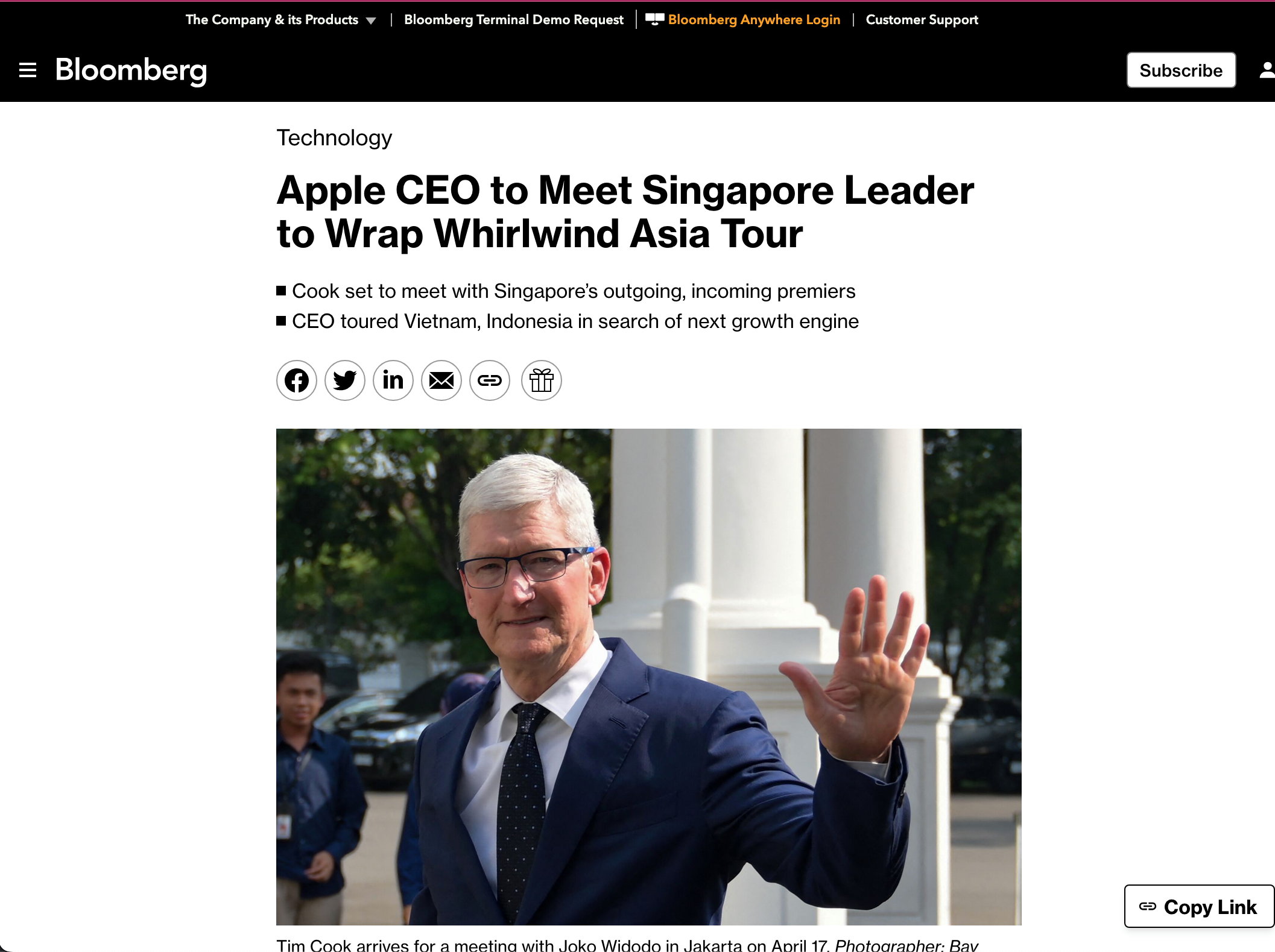

5) Apple CEO to Meet Singapore Leader to Wrap Whirlwind Asia Tour

Summary

Apple CEO Tim Cook is wrapping up a significant tour of Southeast Asia, including stops in Hanoi, Jakarta, and now Singapore, as the company seeks to identify new growth markets and manufacturing locations outside of China. Cook is set to meet with Singaporean leaders, including Lawrence Wong, the incoming Prime Minister, and his predecessor Lee Hsien Loong. Throughout the tour, Cook has emphasized the region's importance as both a market and an emergent manufacturing base, aiming to offset challenges faced in China.

Apple's focus on Southeast Asia reflects its strategy to diversify production and tap into fast-growing markets beyond China. The company is particularly interested in Southeast Asia's more than 650 million consumers. Cook's interactions with local leaders and customers aim to generate interest in the Apple brand and potentially pave the way for a more aggressive sales campaign in the region, where Android phones currently dominate the market.

As part of its expansion efforts, Apple is nearing the opening of its first store in Malaysia and has announced plans to invest $250 million to expand its campus in Singapore. These moves signify Apple's long-term commitment to the region and its recognition of Southeast Asia's growing importance in its global strategy.

Cook's discussions with Vietnamese and Indonesian leaders focused on potential investments and manufacturing opportunities in those countries. The tour underscores Apple's efforts to diversify its supply chain and reduce reliance on China amid tensions between the U.S. and China. While challenges remain, including weak demand in China and high prices limiting iPhone sales in India, Southeast Asia presents new opportunities for Apple's growth and expansion.

If you want to remove the paywall on any news article. Go to our home page and enjoy free articles on us :)